Reporting Gambling Winnings On Tax Return

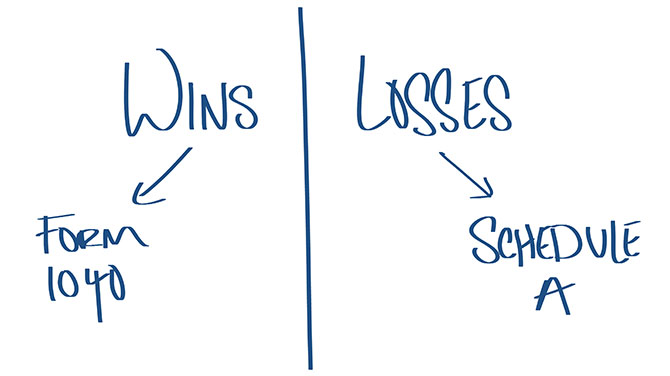

The individual’s status impacts where on the gambler tax return gambling winnings and losses are reported and the outcome on the gambler tax return. When a taxpayer can claim gambling as a trade or business, the gambling winnings, losses and expenses are reported on Schedule C.

What is a Form W-2G

/ScreenShot2020-02-03at11.03.26AM-e376b945aa4e4b7381f63b10e4de9cc2.png)

When most people think about their income, they think about their paychecks, their net business profit, their pension or social security income—the money they’ve worked for and count on every month to pay their bills and cover their expenses. However, not all income is the product of hard work or financial planning, and sometimes a taxpayer can generate income with the flip of a card or the roll of the dice. Lucky lottery players and casino goers likely don’t think about the tax consequences of winning big, but after crossing a certain earnings threshold, those winnings are treated as taxable income.

IRS Form W-2G is issued by a casino or payer to taxpayers who have earned above a specific threshold to report gambling winnings. A payer may also send an IRS Form W-2G if it withholds a portion of your winnings for federal income tax purposes.

Do I have to report my gambling winnings to the IRS?

The IRS treats gambling winnings as taxable income, which must be reported on a tax return. In order to keep track of taxpayer’s gambling winnings, the IRS requires the paying entity (such as the state lotto commission, the casino, or the racing track) to report winnings over a certain threshold.

If a taxpayer wins more than:

- $1,200 from a slot machine or bingo game,

- $1,500 of proceeds from keno,

- $5,000 of proceeds from a poker tournament,

- $600 of winnings from any other game where payout is more than 300 times the wager,

- or any other winnings subject to tax withholding,

Reporting Gambling Winnings On Tax Return Deadline

You are required to report your gambling winnings, including lottery winnings, on your annual tax return. If you win a lottery and you win over a certain amount, the lottery will issue you a Form W-2G, which you'll use to add the winnings to your 1040. The Form W-2G reports your winnings and also reports whether any taxes were withheld before. So before you place that bet, you need to acquaint yourself with the gambling tax laws to avoid problems with the IRS. Some of the information you have to consider include the methods of taxing casino return, reporting of casino return, sharing of gambling returns, keeping of gambling records, and so on. How Casino Winnings Are Taxed. “Gambling winnings are fully taxable and you must report the income on your tax return,” the IRS says. “Gambling income includes but isn’t limited to winnings from lotteries, raffles, horse races and casinos. It includes cash winnings and the fair market value of prizes, such as cars and trips.” Although sports betting isn’t one of. All Winnings Must Be Reported. If, like the vast majority of people, you’re a casual recreational gambler, you’re supposed to report all your gambling winnings on your tax return every year. You report the amount as “other income” on Schedule 1 of IRS Form 1040. You list them as 'other income' in line 21. You may not subtract your.

Reporting Gambling Winnings On Tax Return Irs

then he or she can expect to be required to provide identifying information which allows the paying entity to issue an IRS Form W2G.

Form W-2G Instructions

Form W-2G will request that the taxpayer provide the following information:

- The amount of gross winnings

- The date the winnings were won

- The type of wager that was made

- The amount of federal and state income tax already withheld

When filing his or her tax return, the taxpayer will need to add up all IRS Form W-2Gs received in that year, along with any smaller gambling winnings that may not have triggered an IRS Form W-2G requirement. The taxpayer will also be required to include those earnings as “Other Income” on the first page of his or her IRS Form 1040 return.

Even if you don’t receive a W-2G in the mail before tax season rolls around, you will still be legally obligated to report your earnings on your year-end tax return. Keeping careful track of all of your financial documents, such as wager statements, payment slips, and other gambling receipts, will ensure that you’re able to accurately report your earnings come tax time.

Are gambling losses tax deductible?

Reporting Gambling Winnings On Tax Return

Maybe you enjoy gambling, but you’re not always so lucky with your winnings—there is one bit of good news for you. Although you can’t report your net winnings, you can report your gambling losses as an itemized deduction on Schedule A. However, there’s a catch: losses can only be deducted up to the amount of gambling winnings in a given year.

For example, if a taxpayer spends $500 at the casino, and wins $5,000, he or she will only have to pay taxes on the $4,500 of profit, as long as he or she has proof of the $500 spent. On the contrary, if a taxpayer spent $5,000, and only won $500, there will be no extra tax imposed on the gambling winnings, although the extra $4,500 of loss cannot be used to offset any other non-gambling winnings.

Do keep in mind that the IRS will only accept proof if they believe that the taxpayer him or herself actually suffered the losses—IRS rulings have refused to allow loss deductions based on tickets covered in dirt and footprints, as though they had been collected from the ground after another unlucky gambler had dropped them there.

Reporting Gambling Winnings On Tax Return Social Security

How much tax is already withheld from gambling winnings?

Gambling facilities have the power to withhold part of your winnings for federal tax purposes, however this power depends on the type of gambling activity participated in and the amount of money won. On IRS Form W-2G, the amount already withheld can be found is noted in Box 4, and state and local tax withholdings are noted in Boxes 15 and 17.

Reporting Gambling Winnings On Tax Return Filing

To date, there are two types of withholding for winnings from gambling: regular withholding and backup withholding.

Regular Withholding: The payer withholds 25% of your winnings on cash payments where the winnings minus the wager totals to $5,000 or more.

This applies to winnings from:

- Wagering pools

- Sweepstakes

- Lotteries

- Other wagers (if the winnings total at least 3,000 times the amount of the wager)

Note that regular withholding only applies to non-state lotteries, sweepstakes, and wagering pools, and that the withholding rate rises to 33.33% for non-cash winnings.

Backup Withholding: The payer withholds 28% of your winnings earned from keno, bingo, slot machines, and poker tournaments. This typically only applies when winnings total to:

- At least $600 and at least 300 times the original wager,

- At least $1,200 from bingo or slot machines,

- $1,500 from keno,

- $5,000 from a poker tournament.

Taxpayers may also see their gambling winnings subject to backup withholding if they fail to provide the correct taxpayer identification number to the payer.

Reporting Gambling Winnings On Federal Tax Return

Community Tax can assist with your IRS Help and gambling winnings. Contact Community Tax today for a free consultation: (844) 247-2781